puerto rico tax incentive program

If a section 83i election is made for an option exercise that option will not be considered an incentive stock option or an option granted pursuant to an employee stock purchase. License 00235-0008 Humana Wisconsin Health Organization Insurance Corporation.

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22 Nomad Capitalist

Humana group medical plans are offered by Humana Medical Plan Inc Humana Employers Health Plan of Georgia Inc Humana Health Plan Inc Humana Health Benefit Plan of Louisiana Inc Humana Health Plan of Ohio Inc Humana Health Plans of Puerto Rico Inc.

. Type of federal return filed is based on your personal tax situation and IRS rules. Steak n Shake is seeking qualified single and multi-unit restaurant franchise operators. Visit your military finance office to find out if your service has implemented a specific special pay or incentive and whether you are eligible to receive it.

Participate in the W-2 Early Access SM program. The following is a list of those authorized by law. Assignment Incentive Pay AIP Hazardous Duty Incentive Pay HDIP There are more than 60 special and incentive pays.

For federal income tax purposes the employer must withhold federal income tax at 37 in the tax year that the amount deferred is included in the employees income. Even though Puerto Rico is a vastly different place where these people have. Under our New Franchisee Incentive Program Amendment.

Total Investment of 10k franchise fee. Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US. Have no additional.

21 in Puerto Rico Identity. Here are the biggest benefits from our perspective. Puerto Rico residents can claim child tax credits for qualifying children 17 and under.

The Low Income Home Energy Assistance Program LIHEAP pronounced lie heap is a United States federal social services program first established in 1981 and funded annually through Congressional appropriations. We are selective in awarding franchisee agreements to those with specific qualifications. There are many pros to Puerto Ricos tax incentives.

The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a looming economic collapse. File online with TaxAct and get up to 3600 per child on your 2021 taxes. Moving to Puerto Rico makes people feel comfortable because of the sense that they are still on US soil.

Incentive stock options ISOs. The mission of LIHEAP is to assist low income households particularly those with the lowest incomes that pay a high proportion of household income for. Valid for 2017 personal income tax return only.

The Pros of Puerto Ricos Tax Incentives. Return must be filed January 5 - February 28 2018 at participating offices to qualify. Local government has legislated a series of incentives to attract investment of which EB-5 Visa program participants can also take advantage.

6 months on-the-job training.

Guide To Income Tax In Puerto Rico

Guide To Income Tax In Puerto Rico

![]()

Puerto Rico Investors Conference

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Puerto Rico Offers The Lowest Effective Corporate Income Tax

The Puerto Rico Tax Haven Will Act 20 Work For You

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

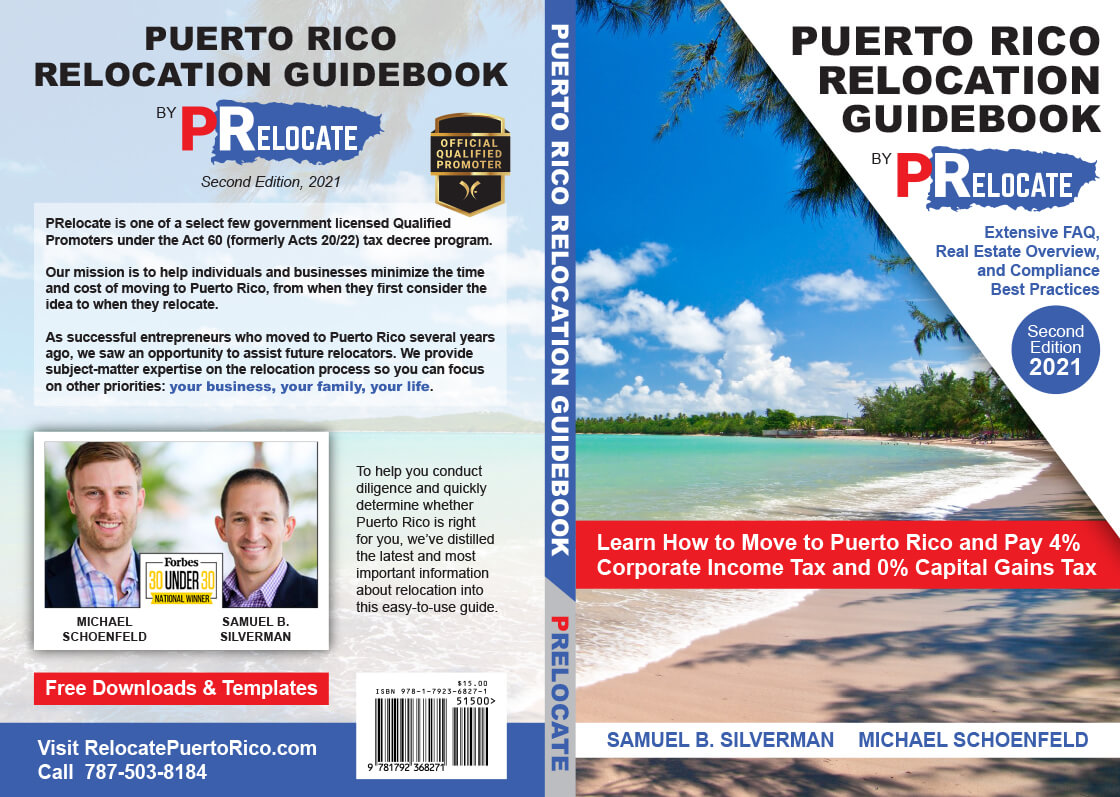

Pr Relocation Guidebook Long Relocate To Puerto Rico With Act 60 20 22

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc